Business Overview

Growing a Future-Ready Business

Global Infrastructure

Our Global Infrastructure business unit develops power transmission infrastructure projects in India and Brazil. We are one of the leading developers of power transmission infrastructure in India, where we bid for, design, construct, own and operate power transmission assets. In India, we typically outsource the construction of our projects to external contractors. In Brazil, we partner with external construction companies to develop projects on a BOOT basis. Our EPC order book for Global Infrastructure business unit (which represents the contracted EPC revenues of our Company (at a standalone level) to be received upon the completion of ongoing projects in India) amounted to approximately ₹ 24,070 Million, ₹ 32,100 Million and ₹ 46,580 Million for fiscals 2019, 2020 and 2021, respectively.

Our assets are located in strategically important areas from the perspective of transmission connectivity, transferring power from generating centres to load centres to meet inter-regional power deficits. We believe this makes their existence critical and their high replacement cost makes the transmission assets indispensable.

The following sets forth a summary description of our ongoing projects:

ONGOING PROJECTS IN INDIA

| S.No. | Project Name | Transmission Line/ Substation | Configuration | Route Length (ckm) | Actual/ Scheduled Commission Date | Total transformation capacity (MVA) | Expiry of TSA | Capital Expenditure, as determined by CEA (₹ Million) | Levellised Tariff (₹ Million) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Khargone Transmission Limited | LILO of one ckt of Khandwa – Rajgarh line at Khargone TPP | 400 kV D/C line | 14 | February 2018 | - | November 2056 | 21,360 | 1,591.13 |

| Khargone TPP Switchyard – Khandwa Pool | 400 kV D/C line | 50 | March 2020 | - | |||||

| Khandwa Pool – Indore | 765 kV D/C line | 180 | March 2020 | - | |||||

| Khandwa Pool – Dhule | 765 kV D/C line | 383 | July 2019* | - | |||||

| Khandwa pooling station | 765/400 kV | - | March 2020 | 3000 MVA | |||||

| 2 Nos. of 765 kV line bays and 7x80 MVAR Switchable line reactors (1 Unit as spare) along with 800 Ω NGR and its auxiliaries for Khandwa Pool – Dhule 765 kV D/C at Dhule 765/400 kV substation | 765 kV line bays | - | July 2019* | - | |||||

| 2 | Lakadia Vadodara Transmission Project Limited | Lakadia-Vadodara Line | 765 kV D/C line | 658 | December 2020 | - | December 2055 | 21,000 | 1,788.66 |

| Lakadia-Bay along with switchable line reactors | 765 kV, 2X330 MVA | - | December 2020 | - | |||||

| Vadodara Bay along with switchable line reactors | 765 kV, 2X330 MVA | - | December 2020 | - | |||||

| 3 | Udupi Kasargode Transmission Limited | Udupi-Kasargode Line | 400 kV D/C line | 231 | November 2022 | - | November 2057 | 7,550 | 847.44 |

| Kasargode Sub-station | 400/220 kV | - | November 2022 | - | |||||

| Udupi Bay | 2x400 kV line bays and bus bar extension | - | November 2022 | - | |||||

| 4 | Goa-Tanmar Transmission Project Limited | Dharamjaigarh - Tamnar line | 765 kV D/C line | 137 | July 2021 | - | November 2056 | 15,310 | 1,647.75 |

| Xeldem - Narendra line | 400 kV D/C line | 187 | November 2021 | - | |||||

| Xeldem -Mapusa line | 400 kV D/C line | 110 | May 2021 | - | |||||

| Xeldem Substation | 400/220 kV | - | May 2021 | 2X500 MVA | |||||

| 5 | Vapi II- North Lakhimpur Transmission Limited | Part-A: LILO at Banaskantha | 400 kV D/C line | 35 | October 2022 | - | December 2058 | 20,000 | 2,565.92 |

| Part-B: Vapi-2 Sub-Station | 400/220 kV | - | April 2023 | 2X500 MVA | |||||

| Part-B: LILO at Vapi-2 | 400 kV D/C line | 12 | April 2023 | - | |||||

| Part-B: 125MVAR Bus Reactor | 12 | April 2023 | - | ||||||

| Part-B: Vapi-2 to Sayali line | 220 kV D/C line | 14 | April 2023 | - | |||||

| Part-C: Padghe to Kharghar Line | 400 kV D/C line | 140 | December 2023 | - | |||||

| Part-C: LILO of Padghe Ghatkopar at Navi Mumbai | 400 kV S/C line | 140 | December 2023 | - | |||||

| Part-C: LILO of Apta to Taloja/Kalwa at Navi Mumbai | 220 kV D/C line | 6 | December 2022 | - | |||||

| Part-D: Pare HEP to North Lakhimpur line | 132 kV D/C line | 59 | June 2023 | - | |||||

| Part-D: 2nos. 132 kV line bays at North Lakhimpur end | 132 kV | - | June 2023 | - | |||||

| Part-D: LILO of Pare HEP to North Lakhimpur Line at Nirjuli | 132 kV | 31 | June 2023 | - | |||||

| Total | 8,440.90 |

*Due to a delay in the completion of the Khandwa Pool – Dhule line, the anticipated COD of the transmission line/substation is November 2021.

(Assets sold)

(Assets under execution)

This map is a graphical representation designed for general reference purposes only

ONGOING PROJECTS IN BRAZIL

| S.No. | Project Name | Transmission Line/ Substation | Configuration | Route Length (ckm) | ANEEL COD | Total transformation capacity (MVA) | TSA Expiry | ANEEL Budgeted Capital Expenditure (BRL in Million) | Levellised RAP (BRL in Million) | ANEEL Budgeted Capital Expenditure (₹ Million) | Levellised RAP (₹ Million)* |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Borborema Transmissao De Energia S.A | LT 500 kV Campina Grande III - João Pessoa II, com 123 km; | 1 x 500 kV Transmission lines (127 km) | 126 | March 2023 | 750 | 30 Years from the date of signing of agreement, i.e. September 4, 2018 | 366.85 | 25.70 | 4,747.04 | 332.56 |

| SE 500/230/69 kV João Pessoa II - 500/230 kV | |||||||||||

| Secc LT 230 kV Goianinha - Mussuré II na SE João Pessoa II - 2 x 0,5 km. | |||||||||||

| Secc LT 230 kV Goianinha - Santa Rita II na SE João Pessoa II - 2 x 0,5 km. | |||||||||||

| Secc LT 230 kV Santa Rita II - Mussuré II na SE João Pessoa II - 2x0,5 km. | |||||||||||

| SE João Pessoa II (setores 230/69kV) | |||||||||||

| 2 | Sao Francisco Transmissao De Energia S.A | LT 500 kV Porto de Sergipe - Olindina C1, com 180 km; | 2 x 500kV Transmission line (387km) | 454 | September 2023 | - | 30 Years from the date of signing of agreement, i.e. September 4, 2018 | 773.0 | 52.51 | 10,002.62 | 679.48 |

| LT 500 kV Olindina - Sapeaçu C1, com 207 km; | |||||||||||

| LT 230 kV Morro do Chapéu II - Irecê C2 e C3 - CD, com 65 km. | |||||||||||

| 3 | Goyaz Transmissao De Energia S.A | LT 230 kV Edeia - Cachoeira Dourada - C1, com 150 km; | 1 x 230kV Transmission lines (150km) | 150 | September 2022 | 600 | 30 Years from the date of signing of agreement, i.e. | 322.00 | 25.32 | 4,166.68 | 327.64 |

| SE Barro Alto 230 kV - Compensador | |||||||||||

| Estático 230 kV - 1 x (-75/+150) Mvar; | |||||||||||

| SE 345/230 kV Pirineus - (novo pátio) em 345 kV - (6+1 res.) x 100 MVA; | March 2023 | ||||||||||

| Secc da LT 345 kV Samambaia - Bandeirantes - C2 na SE Pirineus, com 2 x 1 km. | |||||||||||

| 4 | Marituba Transmissao De Energia S.A | LT 230 kV Janaúba 3 - Jaíba - CD - C1 e C2 - 93 km; | 1 x 345kV (112km) + 1 x 230kV Transmission Lines (93km) | 373 | March 2023 | - | 30 Years from the date of signing of agreement, i.e. September 4, 2018 | 560.00 | 61.63 | 7,246.40 | 797.49 |

| 5 | SE Vineyards Transmissao De Energia S.A(1) | SE Lajeado, LT 230 kV Lajeado 2 - Lajeado 3, LT 23 kV Lajeado – Garibaldi | 3 x 230kV Transmission Line (115km) | 112.4 | August 2022 | 496 | 30 Years from the date of signing of agreement, i.e. August 11, 2017 | 395.00 | 34.53 | 5,111.30 | 446.82 |

| SE Vinhedos (Seccionamento da TL 230 kV Monte Claro - Garibaldi CD | |||||||||||

| LT 230 kV Candiota 2 - Bage 2 | |||||||||||

| 6 | Solaris Transmissao De Energia S.A | LT 230 kV Janaúba 3 - Jaíba - CD - C1 e C2 - 93 km; | 1 x 345kV (112km) + 1 x 230kV Transmission Lines (93km) | 205.2 | September 2022 | 800 | 30 Years from the date of signing of agreement, i.e. September 4, 2018 | 403.00 | 31.43 | 5,214.82 | 406.70 |

| SE 230/138 kV Jaíba - 230/138kV (6+1R) x 33,3 MVA; | |||||||||||

| LT 345 kV Pirapora 2 - Três Marias - C1 - 108 km; | January 2024 | ||||||||||

| SE 500/230/138 kV Janaúba 3 - 500/230 kV (6+1R) x 100 MVA. | September 2022 | ||||||||||

| Total | 2,819.85 | 231.12 | 36,599.12 | 2999.73 |

*Converted from BRL to ₹ using the conversion rate as of March 31, 2021 of 1 BRL= ₹ 12.94

(1) We have entered into a sale agreement with Vinci Energeia Fundo De Investimento EM Participacoes Infraestrutura and Cymi Construcoes Participacoes S.A. to sell our stake in Vineyards with a long stop date of March 2022.

As of April 1, 2021, the total unexecuted project cost of all our ongoing projects in Brazil is ₹ 29,855 Million.

(Assets under execution)

*Assets managed by third party

This map is a graphical representation designed for general reference purposes only

The table below sets forth the total equity investment estimated for our ongoing projects in India:

| Ongoing Projects | Equity Investment (₹ Million) |

|---|---|

| GTTPL | 3,000 |

| NER | 7,850 |

| NER | 7,850 |

| LVTPL | 6,070 |

| UKTL | 1,930 |

| KTL | 4,410 |

| Total | 23,270(1)(2) |

(1) Out of this total investment, AMP Capital's investment amounts to ₹ 9,500 Million

(2) VNLTL, UKTL, LVTPL and GTTPL have entered into EPC contracts with the Company on a lumpsum turnkey basis for supply and services of the associate companies. As per the AMP Framework Agreement, the profit on such contracts are earned entirely by our Company and the profit on sale of SGL13, SGL14, SGL18 and SGL29 will be shared between AMP and our Company

A summary of our Global Infrastructure operational model is set out below:

- Planning and Conceptualisation: We undertake project implementation through a plan that is prepared after identifying the potential major constraints that may impact the cost and schedule of the project. Accordingly, we endeavour to front-end critical activities along with identifying areas where technology interventions may enhance productivity. Further, the timely receipt of regulatory approvals is critical for us to meet the timelines of our projects. Accordingly, we identify areas where government support and intervention are required at the planning and conceptualisation stage.

- Capital Expenditure and Investment Approvals: During the bid stage itself, our project team prepares a detailed cost estimate for each bid based on the scope and technical requirements of the project. We also take inputs from our design and engineering and supply chain management teams for the preparation of the cost estimate. Our investment committee approves the cost estimate prior to the submission of the bid. Subsequently, after winning the bid, the investment committee prepares and approves a bid budget, based on the cost estimate, before we commence the execution of the project.

- Design and Engineering: We prepare optimised designs in compliance with the CEA regulations. Design optimisations for the transmission line are done using power line systems – computer-aided design and draft and for substation layout optimisation, 3D building information systems are used. In addition, we have a large library of tower, foundation and substation designs which are available for use in future projects.

- Procurement Process and Award of Contracts: We have developed healthy and reliable partnerships with reputed EPC suppliers/partners and substation OEMs in the transmission industry. These strong partnerships have played a major role in executing challenging projects and delivering them within the stipulated timeframe. We follow a transparent and competitive process of selecting the EPC and OEM suppliers for each project.

- Detailed Engineering: We refine and further optimise the designs considered during the bid for cost estimates so as to arrive at the perfect blend of cost and strength. The refinement and optimisations during detailed engineering are done based on the inputs received from the detailed survey.

- Quality Assurance and Inspection: Our QHSE policy is aimed at covering the expectations of stakeholders/interested parties, continual improvements of industrial practices and the creation of good quality assets. We endeavour to optimise tower and substation foundation design to consume minimum land and natural resources. We also carry out field quality checks. We also carry out workshops with our EPC partners, civil partners, design engineering, quality, safety and project teams in relation to quality assurance.

- Project monitoring: To monitor and analyse the performance of our projects, we utilise project management processes such as weekly/fortnightly/monthly meetings at different levels within the organisation. These processes help us in avoiding construction errors during execution of work at site. We also have a central project management office which prepares project plans and tracks progress regularly (i.e.monthly, quarterly, semi-annually and annually). This team maintains close co-ordination with all the stakeholders responsible for project execution such as project director, quality and safety team, regulatory team and costing team and offers any catch up/ corrective measures to address any shortcomings.

Key Contractual Arrangements

TSAS AND RSAS

Our subsidiary KTL and the Investee SPVs have entered into transmission services agreements (TSAs) and revenue sharing agreements (RSAs), as required, the key terms of which are provided below.

TSA

In India, power transmissions projects are awarded to us under the TBCB mechanism on a BOOM basis. These projects earn revenue pursuant to TSAs and tariff orders passed by CERC in accordance with the Electricity Act, 2003.

We have entered into TSAs with long-term transmission customers to set up projects on a BOOM basis and to provide transmission services to such customers. The term of each TSA is 35 years from the scheduled commercial operation date of the respective project, unless terminated earlier in accordance with the terms of the TSA. The TSAs provide for, among other things, details and procedures for project execution, development and construction, operation and maintenance.

The inter-state transmission service customers and interstate transmission service licensees are required to abide by the detailed billing, collection and disbursement procedure of the central transmission utility (CTU) and with the terms of the TSA. The CTU raises bills and also collects and disburses in accordance with the detailed billing, collection and disbursement procedures of the CTU, as approved by Central Electricity Regulatory Commission (CERC). The accounting and collection mechanism for the inter-state transmission charges and losses is governed through a TSA executed between the CTU and inter-state transmission service licensee and the disbursement mechanism is governed through an RSA between the CTU and inter-state transmission service licensee. Under the terms of the TSA, each inter-state transmission service customer has agreed to allow the CTU to enforce recovery of payment through a letter of credit on behalf of all the inter-state transmission service licensees in the event of default of payment. If payment by an inter-state transmission service customer against any invoice raised under the billing, collection and disbursement procedure, is outstanding beyond 30 days after the due date or in case the required letter of credit or any other agreed payment security mechanism is not maintained by the inter-state transmission service customer, the CTU is empowered to undertake regulation of power supply on behalf of all the inter-state transmission service licensees so as to recover charges under the provisions of the Central Electricity Regulatory Commission (Regulation of Power Supply) Regulations, 2010 (the “Power Supply Regulations”). In addition, the Sharing Regulations 2010 have been amended and replaced by the Central Electricity Regulatory Commission (Sharing of Inter State Transmission Charges and Losses) Regulations, 2020, which have come into effect from November 1, 2020.

The TSA also provides for force majeure relief to the inter-state transmission service licensees and inter-state transmission service customers (the “Affected Parties”) affected by the occurrence of a force majeure event. The TSA defines a force majeure event as an event or circumstance, or a combination thereof, that wholly or partly prevents or unavoidably delays the Affected Party in the performance of its obligations under such TSAs, but only if and to the extent that such event or circumstance is not within the reasonable control, directly or indirectly of the Affected Party and could not have been avoided if the Affected Party had taken reasonable care, and includes, among others, an act of God, act of war, radioactive contamination, industry-wide strikes and labour disturbances having a nationwide impact in India. To the extent not prevented by a force majeure event, the Affected Party must continue to perform its obligations under the TSA and must use its efforts to mitigate the effect of such event, as soon as practicable. Neither the inter-state transmission service customer nor inter-state transmission service licensee will be in breach of its obligations under the TSA, except to the extent that the performance of its obligations was prevented, hindered or delayed due to a force majeure event. Each inter-state transmission service customer or inter-state transmission service licensee is entitled to claim relief for a force majeure event affecting its performance in relation to its obligations under the TSA. Computation of availability under outage due to a force majeure event must be in accordance to the Central Electricity Regulatory Commission (Terms and Conditions of Tariff) Regulations, 2014 as amended from time to time and any subsequent enactment thereof.

The TSA also defines change in law as being, among other events, (i) the enactment, coming into effect, adoption, promulgation, amendment, modification or repeal (without re-enactment or consolidation) in India, of any law, including rules and regulations framed pursuant to such law, (ii) change in the interpretation or application of any law by the Government of India having the legal power to interpret or apply such law, or any competent court of law, (iii) the imposition of a requirement for obtaining any consents, clearances and permits which were not required earlier or a change in the terms and conditions prescribed for obtaining such consents, clearances and permits; (iv) any change in tax or the introduction of any tax made applicable for transmission service by the inter-state transmission service licensees, as per the terms of the TSA; (v) any change in the licensing regulations of the CERC under which the transmission licence for the respective project was granted. During the construction phase of a project, the impact of increase/decrease in the cost of the project in the transmission charges is to be governed by the formula set out in the TSA. During the operation period, any adjustment in the monthly transmission charges due to a change in law is to be determined and effective from such date as decided by the CERC, subject to rights of appeal provided under applicable law. Further, in case of ISTS awarded through the competitive bidding process under Section 63 of the Electricity Act, the reference date for determining the implications of change in law is seven days prior to the relevant bid due date for submission of a tariff bid.

In addition, the TSAs also identify events of default attributable to the inter-state transmission service licensee which, inter alia, includes failure of commissioning of any element of the relevant project within six months from the scheduled commercial operation date. On the occurrence of such events of default, the TSAs may be terminated in accordance with the procedure set out in the TSAs.

The TSAs also provide for dispute resolution by way of amicable settlement between the parties and where such dispute cannot be resolved amicably, recourse to the CERC is also available, which has the right to adjudicate disputes arising out of the TSAs.

RSA

Pursuant to the Sharing Regulations 2010, the transmission charges billed in accordance with the billing, collection and disbursement procedures set out in the TSAs are disbursed to the inter-state transmission system licensees by the CTU, pursuant to and in accordance with the RSAs entered into by some of our project companies. The Point of Connection (PoC) charges for use of inter-state transmission services by the inter-state transmission service customers are billed and collected by the CTU on behalf of all inter-state transmission service licensees. The CTU must disburse the collected transmission charges to the respective inter-state transmission service licensees and owners of deemed interstate transmission services whose transmission charges have been considered for the purpose of calculation of the PoC charges in accordance with the billing, collection and disbursement procedure set out in the TSAs with the CTU. Delayed payment or partial payment by any interstate transmission service customers results in a pro-rata reduction in the payouts to all the inter-state transmission service licensees and owners of deemed inter-state transmission service whose transmission charges have been considered for the purpose of calculation of PoC charges. The revenue sharing statements to be submitted to the CTU and the modality of disbursements by the CTU must be in accordance with the billing, collection and disbursement procedure. The inter-state transmission services licensee also has a right to dispute the contents of revenue sharing statements before the CERC. Each interstate transmission licensee, under the applicable RSA, empowers the CTU to enforce recovery of payment from the inter-state transmission service customers through payment security mechanisms in the event of default or partial payment by the interstate transmission service customer, in accordance with the billing, collection and disbursement procedure. Each inter-state transmission licensee has further agreed and empowered the CTU to invoke the provisions of the Power Supply Regulations in accordance with the detailed billing, collection and disbursement procedure for any default by the inter-state transmission service customers.

SERVICE CONCESSION AGREEMENTS (BRAZIL)

In relation to our projects in Brazil, our subsidiaries enter into service concession agreements with ANEEL, which regulates the construction, operation and maintenance of transmission facilities. The term of the concession is 30 years. The agreements provide that upon the entry into operation of the transmission project, the project company will be entitled to annual permitted revenue (RAP), as set out in the agreement. Pursuant to the agreement, ANEEL periodically reviews the RAP every five years. In accordance with the service concession agreement, we are liable to pay penalty for unavailability of transmission facilities to ANEEL. Further, we are also eligible for additional RAP as an incentive for improving the availability of transmission facilities.

The forfeiture of the concession may be declared in case of (i) interruption of the public transmission service due to unavailability of the transmission function for a period exceeding 30 consecutive days; (ii) unjustified delay in the execution of authorised works in a period exceeding 180 days. The concession will be considered terminated when: (i) the contractual term ends; (ii) expropriation of the service; (iii) forfeiture; (iv) termination; (v) annulment resulting from defect or irregularity found in the procedure or in the act of granting it; or (vi) bankruptcy or extinction of the transmission company.

OPERATIONS AND MAINTENANCE OF OUR TRANSMISSION NETWORKS

The operation of our partially operational transmission systems is primarily our responsibility.

We are subject to the oversight of the Power System Operation Corporation Limited and CERC, which are responsible for system operation and control, including inter-state and intra-state power management, inter-state and inter-regional transfer of power, covering contingency analysis and operational planning on a real-time basis as well as the operation of regional and state-level unscheduled interchange pool accounts and regional and state-level reactive energy accounts.

Consequently, our operations and maintenance strategy focus on deploying prudent grid management practices to achieve the following objectives:

- to achieve the targeted system availability specified in the TSAs;

- to optimise the life cycle cost of transmission lines by preventive actions;

- to maximise excellence in quality, health, safety, security and environment; and

- to optimise operation and maintenance costs.

We deploy skilled employees and engage third party operation and maintenance agencies to operate and maintain our partially operational assets. We select outsourcing partners, implement sound technical solutions, develop activity charts and conduct scheduled maintenance. We also outsource specific maintenance, repair, supervision and security tasks by choosing capable vendors as well as finalising optimum work orders.

Solutions

Our Solutions business unit specialises in upgrading, uprating and strengthening existing power delivery networks and consists of Solutions (Products) and Solutions (MSI). Solutions (Products) manufactures and supplies a portfolio of overhead and underground products, including power conductors, EHV cables and OPGW. Solutions (MSI) is a fullservice operation which provides bespoke solutions for the upgrade and uprate of existing transmission infrastructure projects. We also offer EHV turnkey services including cable laying and substation development.

Solutions (Products)

OUR PRODUCTS

We manufacture and sell a diversified portfolio of products, covering conductors, OPGW and power cables, to international customers (primarily in Europe and South America), including central and state electricity transmission companies, transmission developers and transmission engineering, procurement and construction (EPC) contractors.

Our order book for our Solutions (Products) business unit (which represents our contracted revenues to be received upon completion of our MSI projects) amounted to ₹ 22,940.68 Million, ₹ 21,927.21 Million and ₹ 19,801.64 Million for fiscals 2019, 2020 and 2021, respectively.

Conductors: We manufacture a range of power conductors ranging from aluminium conductor steel reinforced (ACSR) conductors to High Performance Conductors (HPC), such as composite core, INVAR, aluminium conductor steel supported (ACSS) and GAP-type conductors. Going forward, we intend to focus further on HPC, as these are premium products and provide better margins. We operate three NABL-accredited manufacturing facilities located in Rakholi, Piparia (Dadra and Nagar Haveli) and Jharsuguda (Odisha). In addition, our conductor manufacturing facilities in Rakholi and Piparia scored 94% and 97% respectively, in the Workplace Conditions Assessment audit conducted by Intertek in November 2018.

OPGW and OPGW Accessories: We are a fully integrated manufacturer and solutions provider of OPGW. We have the planning, application, design engineering and execution capabilities to manufacture OPGW for communication, protection and commercial purposes to the standards required by our power systems and utilities customers. We operate an NABL-accredited manufacturing facility in Silvassa (Dadra and Nagar Haveli). As of March 31, 2021, we supplied over 32,000 km of OPGW cable and hardware globally for up to 765 kV lines. In addition, we manufacture OPGW accessories (hardware support products) including tension assemblies, suspension assemblies, vibration dampers, down lead clamps and splice enclosures.

Power Cables: Power cables are electrical cables consisting of one or more electrical conductors, held together with an overall sheath. Power cables are mainly used for power transmission and distribution. We manufacture a wide range of power cables ranging from 6.6 kV to 400 kV. As of March 31, 2021, we have over 110 innovative cable designs in our portfolio, including EHV cables, 3-core cables, fibreintegrated power cables, high-ampacity low-loss cables and cables in co-extruded ducts. We manufacture our cables at a NABL-accredited manufacturing facility in Haridwar. Going forward, we intend to focus further on HPC, as these are premium products and provide better margins. Our power cables are fully type tested as per applicable BIS and International Electrotechnical Commission standards.

Our Manufacturing Facilities

The table below sets forth certain details in relation to our manufacturing facilities:

| City | State/Union Territory | Leased/Owned | Annual Installed Capacity as of March 31, 2021 |

Volume Produced for the year ended March 31, 2021 |

Volume Produced for the year ended March 31, 2020 |

|---|---|---|---|---|---|

| Silvassa (Rakholi) | Dadra and Nagar Haveli | Owned | 25,000 MT per annum with Conventional & HPC product Mix | 15,074 MT | 17,254 MT |

| Silvassa (Piparia) | Dadra and Nagar Haveli | Owned | 40,000 MT per annum with Conventional & HPC product Mix | 14,799 MT | 13,027 MT |

| Jharsuguda | Odisha | 87 year lease | 40,000 MT per annum with Conventional conductor | 22,106 MT | 31,005 MT |

| Silvassa (Piparia) | Dadra and Nagar Haveli | Owned | 14,400 km per annum for OPGW | 10,645 km | 9,801 km |

| Haridwar | Uttarakhand | Owned | 2,400 km per annum | 557 km | 2,399 km |

KEY RAW MATERIALS

In our Products business, the primary raw materials and components we use are aluminium for our conductors and copper and PVC Compounds for cables. The prices of copper and aluminium are linked to the prices on the London Metal Exchange, and the price of PVC Compounds depends largely on the price of crude oil, each of which is generally quoted in US Dollars. Accordingly, the prices we pay for these raw materials can fluctuate due to volatility in the commodity markets or in foreign currency exchange rates.

CUSTOMER CONTRACTS

In our Products business, the vast majority of our customer contracts are fixed-price contracts, with back-to-back arrangements relating to the price of materials and components. For variable price orders, those are generally amendable for fluctuations in the price of materials and components. We also purchase forward-contracts to hedge our exposure to changes in materials and components. As a result, we believe that our Solutions business is generally hedged against fluctuations in materials and components, and our margins are generally not affected by changes in the prices of materials and components.

SOLUTIONS (MSI)

Our Solutions (MSI) business unit provides bespoke solutions for the upgrade and uprate of existing transmission infrastructure projects. We provide our customers, which include cities, power utilities, central and state electricity transmission companies and transmission developers, with custom-built solutions for their energy challenges.

Our Solutions (MSI) projects include upgrading existing infrastructure, increasing throughput, increasing uprate of overhead conductors, implementing OPGW-based reliable communication systems, connecting new HPC lines and installing EVH underground networks. For example, we transformed the Kerala Interstate Corridor through a massive uprate and upgrade exercise which increased throughput in the inter-state transmission network by 15-24 times. In addition, we developed a customised solution to restore a disrupted 400 kV transmission line across 1.1 km of the Ganga river (as a part of the ENICL project). The transmission line had been disrupted for almost two years and restoration efforts were challenged by site conditions of the Ganga River, including the lack of support structures in the middle of the river. To address this unique challenge, we worked on floating platforms and developed a unique carbon composite core ultra-low sag conductor as a long-span transmission solution.

Our order book for our Solutions (MSI) business unit (which represents our contracted revenues to be received upon completion of our MSI projects) amounted to ₹ 5,511.8 Million, ₹ 9,091.2 Million and ₹ 8,341.9 Million for fiscals 2019, 2020 and 2021, respectively.

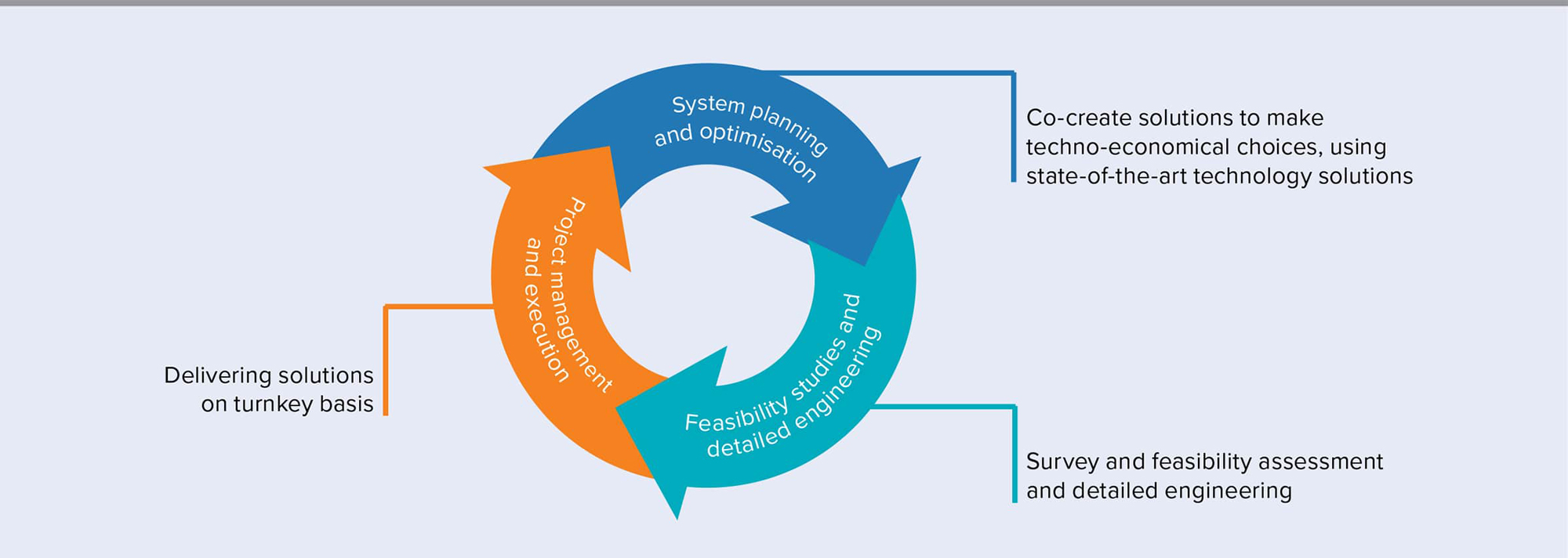

The following diagram broadly illustrates the business model of Solutions (MSI):

System Planning and Forecasting: We leverage our inhouse expertise on power systems to support our customers in their system planning, optimisation and forecasting needs. We help our customers specify their needs and co-create solutions that help them upgrade existing infrastructure in preparation for the future.

Engineering Assessment and Design: Our design and engineering assessment teams conduct surveys and feasibility studies and develop detailed engineering solutions that optimise our customers' space and time constraints. By using technologies such as monopoles and compact power designs, micro piling and GIS substations, we are able to design solutions that aim to minimise corridor footprint.

Uprate and Upgrade Existing Infrastructure: We leverage our technological and project management strengths to help our customers uprate, upgrade and strengthen their existing infrastructure with the aim of minimal outage and disruptions. We also employ various aerial technologies (such as drones) and robotics technologies (such as our SkyrobTM semi-autonomous robot) to string OPGW wires and power conductors safely and efficiently.

CONVERGENCE

Our Convergence business unit leverages existing power utility infrastructure (such as OPGW, transmission towers, distribution towers and substations) for telecommunications purposes by building optical fibre infrastructure on top of existing utilities networks. Our Convergence services include conducting EPC work in fibre roll-outs and leasing neutral dark fibre, co-location facilities and towers to our customers, who include internet service providers, telecommunications companies, multiple system operators, global wholesale carriers and other communication service providers, allowing them to deliver telecommunications, IoT and other services on the backbone of our utilities network.

We also partner with smart cities in an innovative publicprivate partnership (PPP) model to design, build, finance, operate and maintain fibre infrastructure on a long-term partnership model. This PPP model addresses cities' communication infrastructure challenges and provides them with an intracity fiber network, which then acts as the digital backbone for subsequent smart infrastructure in the city. For example, through our PPP with Gurugram Metropolitan Development Authority (GMDA), we have built a 133 km optical fiber network in Gurugram which we will manage and maintain for 21 years.